Michael Pettis, an expert on China’s economy, is professor of finance at Peking University’s Guanghua School of Management, where he specializes in Chinese financial markets. His blog on the Chinese economy attracts a wide audience.

In a recent interview with «Handelszeitung», Pettis discussed the internal imbalances in countries like Germany or China, the global imbalances that continue to characterize trade relations and his philosophy as an economist. The following text is an edited transcript of the conversation, which took place in early September.

Global growth keeps disappointing. What's the main problem?

The main cause of the phenomenon that has been dubbed «secular stagnation» is income inequality. It has become a global problem.

Doesn't capitalism need some inequality?

There is a lot of confusion about this. Theories saying that inequality is good for growth – so-called «supply side economics», which some people unfairly deride as «voodoo economics» – evolved and worked during the 19th century. But they don’t apply for the 20th and 21st century.

Why not?

Investments used to be constrained by the lack of savings back in the 19th century. The United States had huge investment needs, which couldn't be met out of domestic savings. Income inequality in Europe and particularly in England helped to foster growth in this context. Rich people's savings were channeled to the U.S. and everybody was better off. But today the lack of savings doesn't constrain investment any more.

Ultimately: by income inequality. Countries with high degrees of inequality generate too much savings but too little consumption demand. As a consequence, firms don't invest enough in their production and so investment demand is also weak.

Where do the savings go instead?

They flow into non-productive investment like housing, or into stock markets and real estate, where they push up prices. That's what happened before the crisis. The middle class felt richer, took on more debt and spent more money. After the bubble burst, the savings rate was brought down through unemployment. Fired workers stopped producing but kept on consuming.

Can central banks do anything?

Not really. Central banks have flooded the market with liquidity. They have managed to keep asset prices high – far too high in my opinion – hoping that this will boost consumption. But this way of creating growth is unhealthy. It increases inequality, as high asset prices mostly benefit the rich. And it gets less effective over time, as rich people are not going to increase their consumption much.

What should be done instead?

One solution would be for the United States and for many countries in Europe to borrow all this cheap money and build the infrastructure that they need anyway. But for political reasons this is not done. The other way to get growth going is by reducing inequality.

Take from the rich – give to the poor?

In U.S. history there is a regular cycle of rising inequality and political redistribution. It has happened most famously in the 1930s but also several times before. Governments increase taxes on the wealthy. Inequality can also be reduced through inflation, because inflation reduces mostly the wealth of the rich. Bond defaults also reduce inequality. Massive sovereign bond defaults have happened time and again in history. Again, this hurts mostly the rich. And ultimately, war is also an event where rich people's assets are destroyed and inflation goes up.

If we exclude war, what's the preferred solution?

We clearly want political redistribution. Inflation and default are destructive ways of redistributing wealth. You redistribute by making the rich poorer and not the poor richer.

After World War II there was a bit of everything: inflation, taxes, defaults. Can we learn something from that era?

Yes. The economic regimes after WWII were explicitly designed with the 1920s and 1930s in mind. Western nations decided they weren’t going through a depression and a consecutive war again. For a while they didn’t, but then they forgot about these lessons. Today's situation is similar to the 1930s – with one big difference: It's the first global crisis with a credible fiat currency in place.

What does that imply?

In the old days monetary expansion was constrained. Central banks had to stop printing money when they ran out of gold. Since the financial crisis of 2008 this hasn’t been a constraint, and I think it's not going to be a constraint for some time. Unfortunately it means we are able to postpone the adjustment that occurs in the form of crisis and allow debt levels to build. This seems to be what happened in Japan, and this could end with all of us becoming Japan.

What's so bad about Japan?

Japan takes on more and more debt and effectively monetizes it. The problem with this is not inflation, as many people think. It's the purchasing power that is given to the government. This power is ultimately taken from the households who own monetary assets, and so reduces the growth of consumption.

Would it be a reasonable alternative to give «helicopter money» directly to the people?

If you distribute helicopter money, then this is probably the best way to do it. Supply siders will tell you that if you give every household 1000 Francs, they'll just save the money – because they are rational and know that taxes will go up in the future – but that's nonsense. Poor families and people in debt will use the money to consume or to reduce their debt. This will boost consumption, which will then increase investment by the private sector.

The U.S. has a debt-to-GDP-ratio of 100 percent. Is that too high?

It’s useful to look at debt-to-GDP from one period to the next to see how quickly debt it is growing. But in itself the number is meaningless, especially for comparing countries.

Why?

There is a difference between your debt and your debt burden. If you borrow 100$ to consume, your debt goes up by 100$ and so does your debt burden. If you are China and borrow 100$ to invest in a project that is only worth 50$, your debt goes up by 100$ while your debt burden only goes up by 50$. But if you are in the U.S. and you borrow 100$ to improve transportation links between New York and Washington, that would be worth at least 100$. Your debt would go up by 100$ but your debt burden would actually go down. Taking on debt for productive reasons is never wrong.

How productive was the debt that western countries have taken on recently?

Unfortunately a lot of it was not. But that doesn't impact the assessment for future borrowing. If Europe and the USA borrow money to build infrastructure this should be productive.

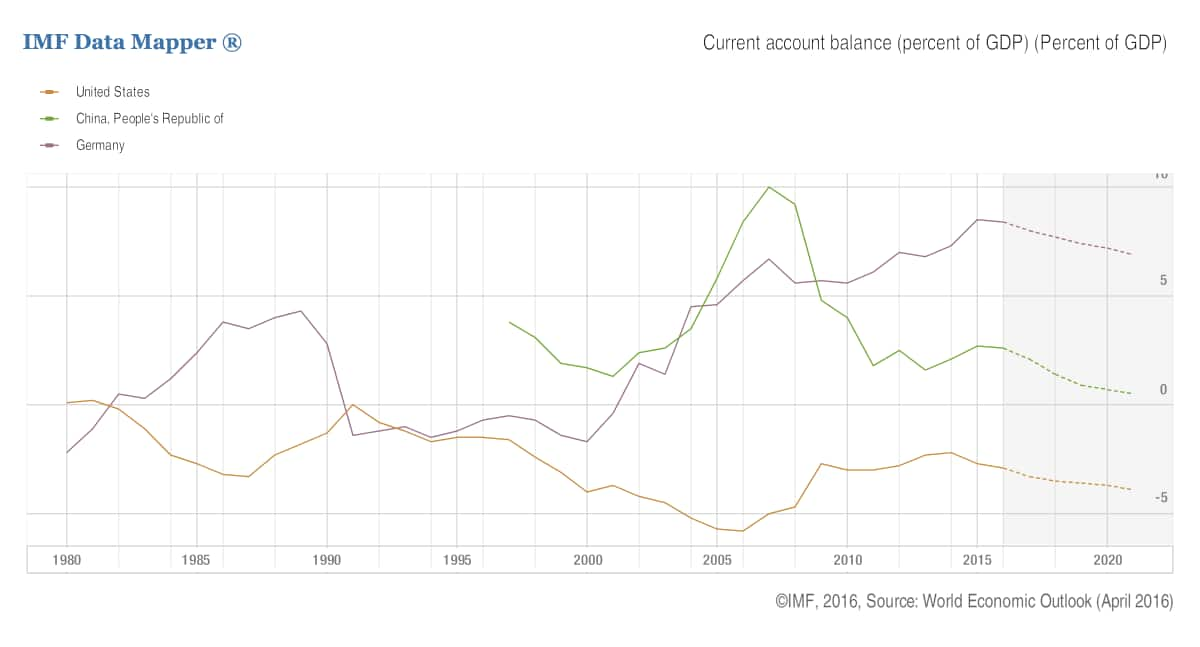

The U.S. is also running a trade deficit. Should we be worried?

Yes. The European crisis is a result of the domestic imbalances in Europe. And the global crisis is at least partly a result of the imbalances between the U.S. and China and Japan. These have now been made worse by the surging European surplus.

What's the problem with these imbalances?

The story starts with the capital exports by Germany and East Asia. Let’s say that China exports 1 trn $ of capital to the US. In this case, the US has to run a 1 trn $ current account deficit – unless it blocks the capital, which it doesn’t. That means that either investment in the US must go up by 1 trn $ or savings must go down by 1 trn $ – or some combination of these two things must happen. Since the US didn’t need Chinese capital to fund its investment, the capital inflow will have no effect on US investment, so the only way to rebalance is for US savings to decline. There are only two likely ways this can happen. One way is that Chinese capital ignites an asset price boom, which increases consumption in America through the wealth effect. The other way is through increased unemployment, which forces domestic savings down. The same thing goes for Spain, which is faced with capital exports by Germany.

Before the crisis, imbalances resulted in bubbles. Will they result in stagnation today?

Yes – unless the U.S. turns against free trade. And here comes the really dangerous part of the story. We live in a world of weak demand. In this world, countries like the U.S. with a large current account deficit and a diversified economy can lower their unemployment and increase their growth if they erect trade barriers. The US economy would immediately improve if the U.S. turned anti-trade or implemented income-distorting policies typical of China, Japan and Germany, in which case those three would suffer enormously.

Is Donald Trump right when he proposes to restrict trade with China?

Donald Trump says many contradictory things – this means that some of his statements are necessarily going to be right, if only by accident. I am not sure Trump would really understand how to implement a good trade policy, in the unlikely case that he wins. But trade is under pressure anyway. The environment already got worse, international trade as a share of global GDP is turning negative at this point. The shift of attitudes has also affected Hillary Clinton, who is no longer committed to free trade.

What's your explanation for this shift?

Both in Europe and in the United States the last few decades were wonderful – but only for the upper incomes. People with low incomes actually got poorer. We all knew that but it didn’t seem like a big problem. We kept saying: «eventually they’ll be better off.» But after 30 years you really have to start questioning this notion of «eventually». Politicians have to deal with that problem. If Trump loses and Clinton doesn’t fix the problem, there will be another Trump next time around. The same will happen in Europe.

Was Trump an accident waiting to happen?

Yes. There is a faction in American politics that always emerges during periods of significant income inequality: the Jacksonians. Their emergence usually provokes a reversal in income inequality. This happens in large parts because they scare the hell out of the establishment.

Is it the same story with Brexit?

Brexit was also about a lot of people being extremely fed up with the cultural, political and business elites, who keep saying that these people are idiots and should be ignored. But that's wrong. Most of the voters are neither racists nor idiots. They are just people who are disappointed with their situation and are no longer willing to trust the elite.

Has democracy failed?

Democracy loses prestige when there is a perception that it doesn't do a good job in leading. This wasn't any different in the 1930s. Of course, non-democracies are no better at choosing the right path. The great value of democracy ultimately is its ability to adjust. Winston Churchill once said that the United States always does the right thing – but only after trying all the alternatives. This is how all real democracies operate, and not just the US. We make mistakes but we quickly back away from them.

What if Trump wins the election?

Trump won't win. The real question of this election is how large the sweep will be. Will Hillary Clinton get control of the house and the senate? Trump is caught in his spiral of anger. He has to be more and more outrageous if he doesn't want to lose support. At some point, he inevitably crosses the line and people get disgusted.

What would an American trade war mean for the rest of the world?

If the United States turned against trade, that would be bad for the global economy over the long term. And in the short term it would even be more devastating for Japan, China and Germany. These economies would collapse.

Why?

Japan, China and Germany are heavily dependent on their exports to the rest of the world, and directly or indirectly that requires a US deficit. Their economies are extremely one-sided. This makes them vulnerable, and also adds to the main problem of the global economy: insufficient demand. Germany was recently placed on Washington's currency watch list. This is no coincidence. Behind the scenes, U.S. officials have been angry at Germany for a long time.

Why should you punish a country for its virtues?

Germany's trade surplus is no virtue. We tend to think that «export champions» are running surpluses because they have good policies or hard-working people, but in fact it isn’t true. In a country with good policies, hard-working and productive citizens are rewarded with lots of imports, which their exports pay for.

So why does Germany run a surplus then?

Persistent trade surpluses are mostly due to distortions in the income distribution. Both China and Germany show this perfectly. In China, the household income share of GDP has been low for 30 years. In Germany it dropped right after the Hartz reforms. Consumption went down, savings went up, and the current account surplus emerged. That was also the moment when in Spain, Italy, France and Greece surpluses or small deficits turned into huge deficits. Germany still lacks domestic demand. That’s why it has to export the excess.

What about over-borrowing in southern Europe? Wasn't that the real problem?

This is another misconception. Many people in Spain are beating their breast and saying «Oh, it’s our fault for borrowing irresponsibly». It's not. Countries always struggle to cope with massive inflows of very cheap capital. History shows that. Germany had this same problem after the war with France in 1870, when reparation payments led to a massive transfer of capital from France. Germany experienced a real estate and a stock market bubble, a collapse in industrial production, a surge in services and rising levels of debt. This went on until a crisis hit in 1873, which was followed by a very long and painful recovery.

What policy would you recommend for Germany?

The slow and correct process would be to redistribute income back down to the workers and the ordinary households. The problem is that this takes time. To bridge the gap, Germany should increase domestic infrastructure spending. They just have to start absorbing everything that they produce. If at some point the rest of the world either refuses to absorb the German surpluses, or are unable to – like the countries that in peripheral Europe that were effectively bankrupted by German policies – then Germany will have no place to sell its massive overcapacity. In that case it must reduce that overcapacity by letting unemployment rise sharply.

Why do you always argue with macroeconomic identities?

If as an economist you don't think of the economy as a system, you are likely to give unhelpful advice. You make one thing better and another thing worse. Starting from macroeconomic identities is an attempt to avoid these traps. An identity is like 2 + 3 = 5. You cannot possibly disagree with it. Thinking systemically helps to exclude solutions where 2 + 3 = 6. That's all. This kind of thinking doesn't necessarily tell you how actors like the government, like firms or consumers will behave in the next quarter or year. But it allows you to build a set of all the scenarios that are logically possible. Some of these will be more likely, others less.

Was the euro crisis a consequence of politicians trying to bend the rules of logic?

Yes. Germany's reforms hurt German workers and left them with a lower wage share of what they produced. This automatically forces up the national savings rate, even though German households were no thriftier. The accounting identity tells us this had to happen. The accounting identity also tells us that unless its investment rate rose, Germany had to run a surplus under these conditions, and even more so when German investment actually declined. Of course if Germany ran a surplus, somebody had to run a deficit, and thanks to the euro, this was peripheral Europe. Because of the euro there weren't any of the old adjustment mechanisms in place, and this led first to rising debt and later to the crisis. The logic is really straightforward. There was no sudden consumption binge in Spain, France and the other peripheral countries caused by irresponsible behavior on their parts. If that was the case, interest rates should have gone up. But they went down.

source: tradingeconomics.com

Will the Euro crisis resolve itself over time?

Countries in peripheral Europe ultimately won't be able to pay off their debts. Politicians can pretend that they will, but the longer they play this game, the worse it will be. Ultimately the debt will be written down.

Even in countries like Italy or France?

I focus mostly on Spain, because I was born and grew up there – and because Spain was actually an example for responsibility prior to the crisis. It was one of the only countries with a fiscal surplus. It had tighter banking regulations than others. And, contrary to the stereotypes, the Spanish worked more hours a year than the Germans. If it proves impossible for these «good guys» to repay their debt, then it will also be impossible for the other countries with much worse numbers than Spain.

What makes you so sure that Spain is essentially broke?

Spain has too much debt. To reduce the level of debt, the country would need very fast growth. But the last two years show that growth is not happening. Even under optimal conditions – dramatically declining energy and metal prices, scores of tourists visiting Spain because they are afraid of terrorism in France and the eastern Mediterranean, plenty of liquidity, rich foreigners buying tons of real estate at the coast – GDP only grew by 3.2 percent. Meanwhile, the deficit was 5.2 percent. So debt is growing faster than GDP and nothing can stop it.

What does the end game look like?

One likely scenario for Europe is «japanification»: years of financial distress, high debt and low growth.

Germany says: Europe would be fine if all countries imitate Germany.

In that case every country would run a huge surplus. Macroeconomically, this is not possible. Not everyone in the world can run a surplus. We can't all be like Germany squeezing workers wages and exporting their production that they cannot buy themselves.

Will Europe end up divided into a rich north and a poor south?

Europe could break up if Germany doesn't quickly resolve its problem of insufficient demand. Unemployment is still incredibly high in Spain and in the rest of Europe. It has only temporarily gone down because of the good tourist season. Debt levels are growing much too quickly. I don’t know how much longer people will tolerate this.

Is China closer to rebalancing?

China knows that it has to rebalance. But I don’t think they have a very clear sense of timing.

What do you mean by that?

In the end, countries always rebalance. The question is: Does it happen according to a plan or not. In the 1930s, rebalancing in the US happened in the form of a crisis. From 1930 to 1933 GDP in the United States dropped by 35 percent, while household income went down by about half that amount. That was painful – but it rebalanced the economy. In Japan, rebalancing happened in the form of stagnation. In the 20 years after 1990, GDP grew by around 0.5 percent while household income grew at 1 to 1.5 percent. These are the only two ways rebalancing occurs.

Can China find a middle way between these extremes?

The best way to rebalance would be to transfer wealth from the local governments to the household sector.

The state should give its property to the people?

The province of Shanghai is doing exactly that: They are distributing state-owned enterprise (SOE) shares to the workers. Other ways are conceivable too. China could privatize the SOEs and use the money to improve social services or education. What matters is that local governments lose control over these assets.

Why?

China will only be able to achieve rapid growth if it resolves its debt problems. This means that they have to allocate the cost to somebody. The options are limited. China can't allocate the cost to households, because it needs their consumption to drive growth. China can't allocate the cost to SMEs because they are the only efficient part of the economy – without them, there won't be any growth for a long time. China isn't going to allocate the cost to the central government. That only leaves the many local and provincial governments.

Can the local governments sustain the losses?

Yes, probably. China has grown at 10 or 11 percent for about 30 years. Recently, some of that was fake growth, because worthless stuff was built. But nonetheless over the whole period government wealth expanded faster than GDP while household wealth expanded more slowly. The state owns an awful lot of things. However, not all of these things are up for sale. Selling real estate is problematic because prices could collapse. So essentially, it has to be the SOEs. China understands that. But of course there are political fights around the process.

Who is on which side in this fight?

I understand the fight from an institutional perspective. Albert Hirschman described this perspective when he wrote about Latin America about half a century ago. Like these countries back then, China has put very successful policies in playce. These policies created a lot of growth, but also a class of institutional beneficiaries – the so-called vested interests. These interests prevent China from changing its policies, even if they aren't needed any longer. Local elites who are in control of local government assets are reluctant to give up their power.

China's president Xi Jinping is tightening his grip. Is this a part of this economic fight?

Yes. When my students and I put together our best-case scenario for China in 2009, we said that the next president must dramatically centralize power. Economic history shows that when countries try to implement the reforms that China has to implement now, there is usually tremendous political opposition. Successful rebalancing only happened under two extremes: either in a democracy, as in the United States in the 1930s, or in a highly centralized autocracy – as in China in the 1980s, when Deng Xiaoping was able to implement tremendous reforms, very much opposed by the communist party elite, thanks to his personal powers. Since my students and I assumed that China would not be a democracy in three or four years, we inferred that the next leader has to centralize power.

Is increasing censorship really helpful in this context?

Centralized power isn't necessarily a good thing. It's just very hard to imagine how China would implement the necessary reforms otherwise. Censorship and self-censorship have been a reality in China for a long time and will probably continue to be so for a while.

Does China have to improve transparency to attract more foreign investment?

Transparency is important in the long run. But right now, countries like Germany, China or Japan aren't facing any funding constraints. In fact, they are desperate to put their money somewhere. If any country said to China, «be careful or we will stop investing», this would be an empty threat.

When will China liberalize the Renminbi?

Chinese politicians think that if their currency becomes more important, their country also becomes more important – which is a very big deal in China. So there is a political will to internationalize the Renminbi. But amongst economists the sentiment has shifted. Even the IMF stopped saying that all countries should lift their capital restrictions. I think they are right.

Why?

Unchecked cross-border transactions of capital exacerbate the risk of financial crises in developing countries. Unlike mature economies, these countries get tremendous outflows when things go bad. The outflows happen exactly at the wrong time. Having a healthy and flexible banking system is a minimum requirement to open your capital account. But China is nowhere close to that. Internationalizing the Renminbi by the early 2020s is not a realistic plan.

Wouldn't China profit if the Renminbi became a global reserve currency?

Having a reserve currency forces a country to consume beyond its means. That's why it's actually not an advantage. Most countries try to prevent their currency from achieving that status. Japan got very angry when China bought Yen a few years ago. Many economists also think that the U.S. should take steps to prevent the excessive use of the dollar.